Home Finance Ledger & Budget Planner

Looking for a budget planner? Something easy-to-use that can help you manage your money and reach your financial goals?

Introducing the Home Finance Ledger & Budget Planner, an Excel spreadsheet developed by Dr. Nathan Cobb.

Financial pressures are one of the leading causes of stress on couples and families. A 2015 survey by SunTrust Bank in the USA, found that of just over 2000 respondents, 35% said that money problems were the primary cause of relationship stress, while that number jumps to 44% among those aged 44 to 55, (followed by annoying habits, at 25%). On this same survey, nearly half, or 47%, said they had different spending or saving habits than their partner [1].

In a similar survey of 1007 adults, conducted by Ally Bank in 2014, more than half of those surveyed (55%) reported that a strong budgeting and saving strategy was the most appealing money-management trait in a significant other, and that preference grew stronger in older age groups [2]. Clearly, having access to tools and resources to help you manage your personal finances can be a strong asset to your relationship in today's world.

The Home Finance Ledger and Budget Planner offers an inexpensive and easy-to-use solution to your budgeting and personal money management needs.

What you get is a ready-made Excel spreadsheet consisting of multiple tabs (or worksheets) that help you

- make a budget for the year, plan ahead, and know your cash flow for the next twelve months

- make and use easy monthly budgets that are inclusive of all inflows and outflows, have high specificity, and can be adjusted easily when your circumstances change

- manage your savings goals

- manage reimbursables

- keep your chequing account up to date, and

- categorize expenses

all with minimal time investment, approximately five minutes per day.

What makes this system different?

Given that free budgeting and financial spreadsheets are available for download on the internet, you might wonder why you would want to pay for a spreadsheet like this one? Wouldn't one of the free spreadsheets available do the same thing?

My short answer is no. Free spreadsheets typically do not offer the full scope of features and benefits that you will find in the Home Finance Ledger & Budget Planner.

It even provides benefits that are typically not found in more expensive, brand-name personal finance software packages, whether they be desktop or web-based (I speak from experience, after using one of them for over twenty years, and looking around for alternatives). The main benefit, not found in most of these other packages, is the ability to plan ahead for the year and see how your cash flow will change month-by-month.

Additional benefits not found in most other packages include the ability to:

- Track money set aside in a savings goal as a budget item.

- Track your reimbursable expenses and reimbursement payments easily, and as part of your budget.

- Pay down outstanding credit card balances as a budget item.

- Easily, and with minimal fuss, set up an annual budget that shows all inflows and outflows.

- Set up an annual budget that is easily adaptable to your changing circumstances. Monthly cash flow forecasts become increasingly more accurate as the year progresses. (i.e. you do not have to keep "re-doing the budget" every few months, yet your confidence in it will still increase with each passing month).

- Quickly and easily set up monthly budgets that show all inflows and outflows for the month.

Many hours of development have gone into this spreadsheet. With it you can also:

- Keep track of multiple accounts, and multiple types of accounts.

- Assign multiple categories to a single transaction.

- See actual inflows and outflows automatically reflected in your budget worksheets. All you do is plug in your planned inflows and outflows.

- View reports that can help you track account balances and expenditures.

- ... And so much more.

keep track of your finances in multiple accounts

With this system you can record transactions in your checking account; savings account; cash-on-hand; credit card; line of credit; fixed loan accounts, including student loans and your mortgage; an investment account; and a reimbursable account.

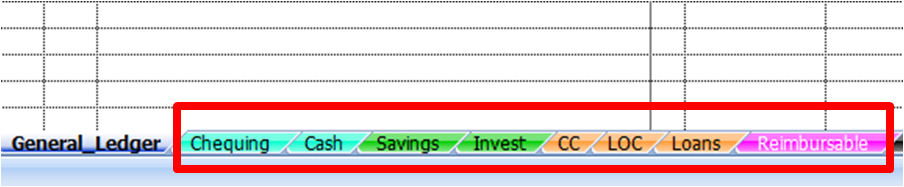

Figure Showing Account Tabs for Chequing, Savings, Investment, Credit Card, Line of Credit, Loans, and Reimbursable Accounts

Figure Showing Account Tabs for Chequing, Savings, Investment, Credit Card, Line of Credit, Loans, and Reimbursable AccountsEach tab (or worksheet) can track up to three accounts at once. If you have two chequing accounts, for example, you can record them both in the same Excel file, and transactions from both accounts will be reflected in your monthly budget. Each account register looks like those shown below, and are similar to what you would find in a paper cheque register.

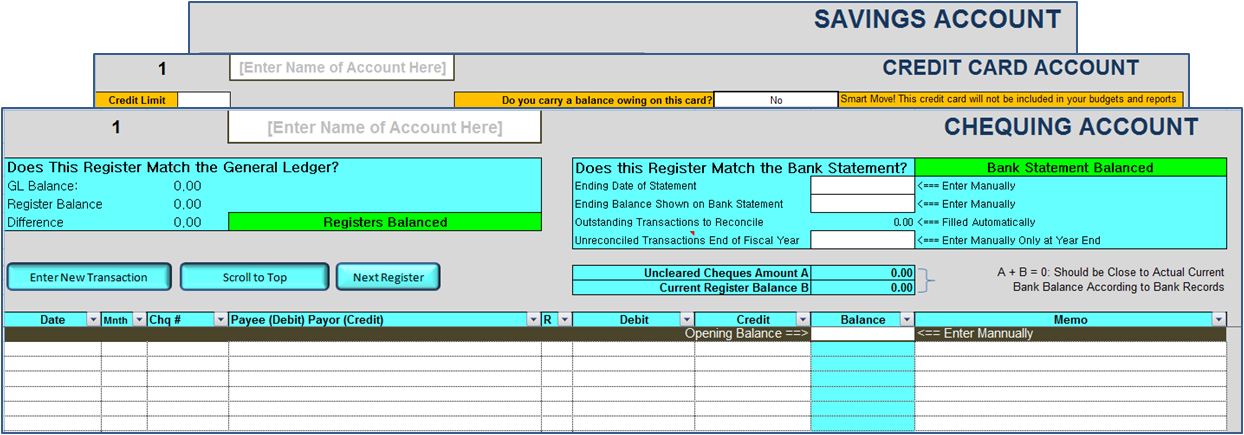

Figure Showing An Example of the Chequing Account Register

Figure Showing An Example of the Chequing Account RegisterEasy-to-use monthly budgeting

This spreadsheet offers twelve budget worksheets, one for each month, all ready for you. All you have to do is enter the amounts you plan to spend in each category in any given month. All it takes is about five minutes at the start of the month. A comprehensive set of pre-defined categories have already been entered into the system, but they can be customised to your situation, if you wish.

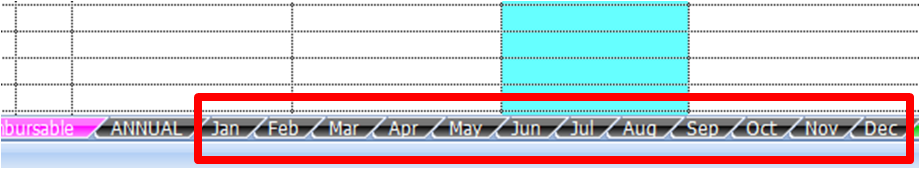

Figure Showing Monthly Budget Pre-Set Monthly Budget Tabs, One for Each Month

Figure Showing Monthly Budget Pre-Set Monthly Budget Tabs, One for Each MonthAs long as you stay current in entering your transactions manually, your budget will automatically show you how much money has been received or spent in each category to date in any given month.

Get immediate feedback on what you have spent on eating out, gas for your car, groceries, or clothing, among other categories.

Discover how much you have left for spending in each category as the month progresses.

Compare what you had planned to spend against actual spending so that you can make on-the-fly adjustments in your budget for the remaining part of the month.

Printable budget worksheets give you and your partner a hard copy of your budgets to review together as needed.

Account for All Inflows and Outflows in Your Budget

For your budget to be truly useful to you, it must have a way to account for every dollar you use or set aside, and for every dollar you receive each month. Not every dollar you spend gets used on regular expenses, for example. Some of it you spend on reimbursable expenses (you loan it out to someone who is going to you back) or paying down debt. Some of it you will set aside in a savings account. Some of it you may put in an investment account, for use in purchasing investments.

In addition, money you receive each month includes not only income from your job, but also reimbursement cheques you receive (when your insurance company pays you back for that visit to the dentist), or transfers from your savings account or investment account back into your chequing account, when needed.

The monthly budget worksheets in this system account for all of these extra inflows and outflows. Tracking all inflows and outflows in your budget like this provides you with a more accurate financial picture of your overall monthly cash flow. Prior to building this spreadsheet, I used a well-known brand of financial management software for twenty years, and I can tell you it was a frustrating experience trying to account easily for these extras in the budgeting features of such packages.

Fluid and Adaptable Budgets

Budgeting is also only useful to the extent that it adapts to changing circumstances. You do your best to plan a budget at the start of the month, but things always come up. Your son comes home with an extra $100 school fee that you had not counted on, and it is due next week. Your furnace breaks down, or some other expense comes up.

Your budget is a tool in your belt to help you, not a rigid school master that has to be followed religiously. It needs to be fluid and adaptable. You need to be able to look at your budget and see how much has been spent already in the month, and see what other categories have funds available for spending that you could draw from to cover those unanticipated transactions when they come up.

Perhaps you decide to go with less eating out for the rest of the month, or to put off buying a new jacket, and re-route those funds to pay the school fee. Or you might decide you can draw funds from a savings goal to cover it. Our budget worksheets are thus designed to help you see where you can make changes in your spending for the rest of the month.

set up an Annual Budget in just minutes

But what if you'd like to create an annual budget for the year, so you can plan ahead? The monthly budget worksheets are great tools for a specific month, but filling them all out at once for the whole year would be very tedious. That's where the Annual Budget is useful.

You can prepare a comprehensive annual budget that can adapt easily to changing circumstances as the year progresses.

The Annual Budget template is pre-set for you. All you have to do is enter the income and expenses that you anticipate in each category throughout the year.

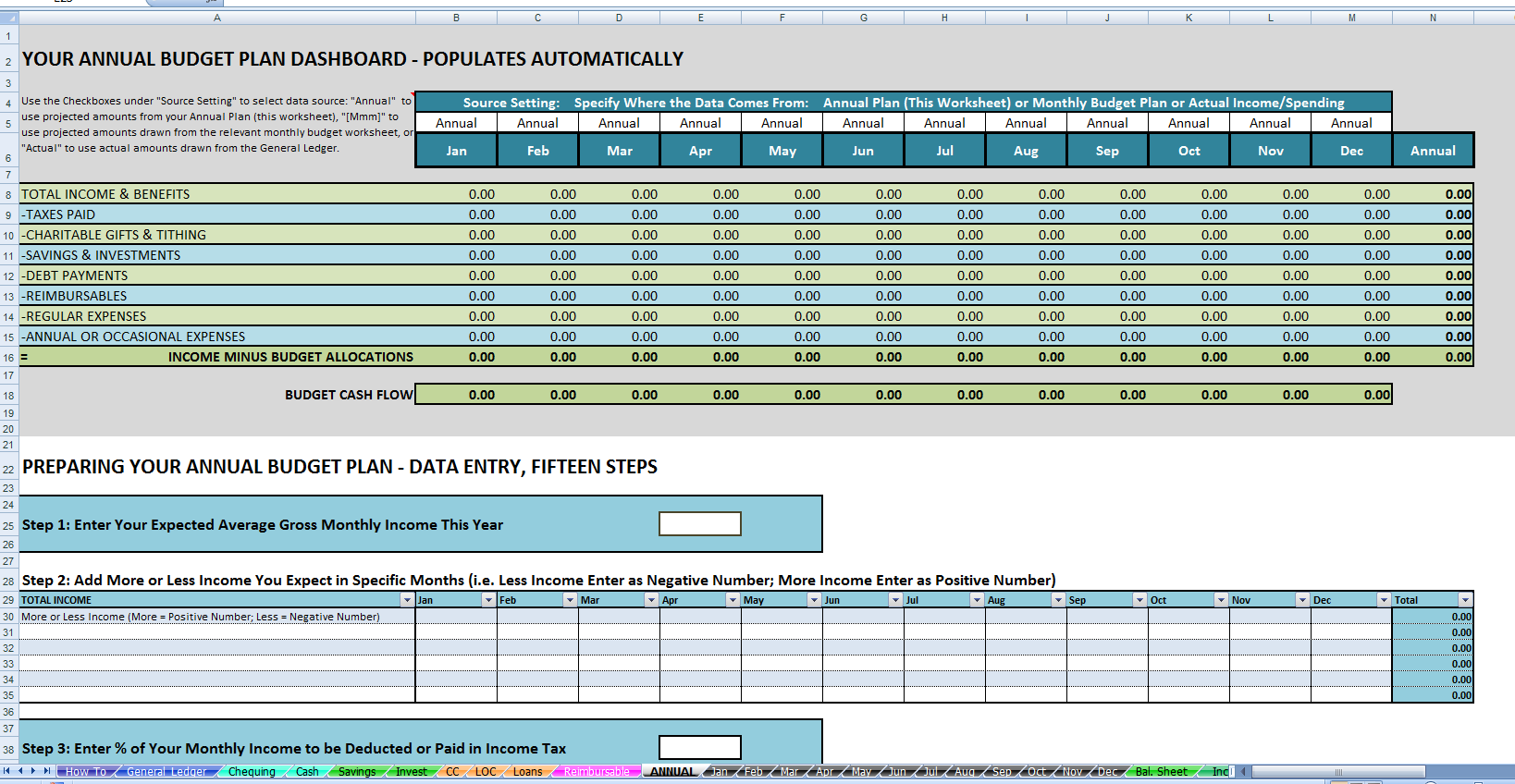

Once you complete the fifteen-step process, which takes about five to ten minutes, the Annual Budget Dashboard (see below) shows your planned income and expenses, month-by-month.

Your annual budget then works in tandem with your monthly budgets as you create them.

You can manually set each month column in the dashboard to draw its data from the input you just entered in the annual budget, which will give close but approximate estimates, or from the specific monthly budget worksheet you set up for that month. (Data from the monthly budget worksheets are likely to be more accurate and inclusive than the estimates from the annual budget worksheet once that month actually arrives since you will have more information by then in front of you).

Once a month is over, you can then manually re-set its column in the dashboard to automatically draw its information from actual transactions recorded in the General Ledger.

Thus, as the year rolls on, completed months will show actual data, the current month will draw its data from the monthly budget, and the remaining months will draw their data from the annual estimates you entered at the start of the year.

This method minimizes duplicate data entry, while ensuring that your annual budget dashboard is flexible, fluid and changes automatically to your changing situation as the year progresses, so that your confidence in the accuracy of your annual budget forecasts increases with each passing month. By the end of the year, your annual budget dashboard gradually switches from being a forecast of the year at the beginning of the year to becoming an income and expense report by the end of the year. From February to November, the annual budget dashboard is a hybrid of the two. This is a unique feature not found in other financial software.

The main benefit of this feature is that it allows you to see how your cash flow will unfold each month of the year. You will be alerted to months where your cash flow may be low so that you can plan ahead to cover those months, or where it may be high so that you can save more in those months.

There is room in your annual budget to plan for one-time, large expenses that come up in the year, including vacations, house renovations, religious holidays, and so on.

Figure Showing the Annual Budget Dashboard as well as the Beginning of the 15 Steps to Filling Out Your Annual Budget. Note that the Dashboard Shows You a Preliminary Budget for Each Month of the Year.

Figure Showing the Annual Budget Dashboard as well as the Beginning of the 15 Steps to Filling Out Your Annual Budget. Note that the Dashboard Shows You a Preliminary Budget for Each Month of the Year.useful Reports show you where your money is going

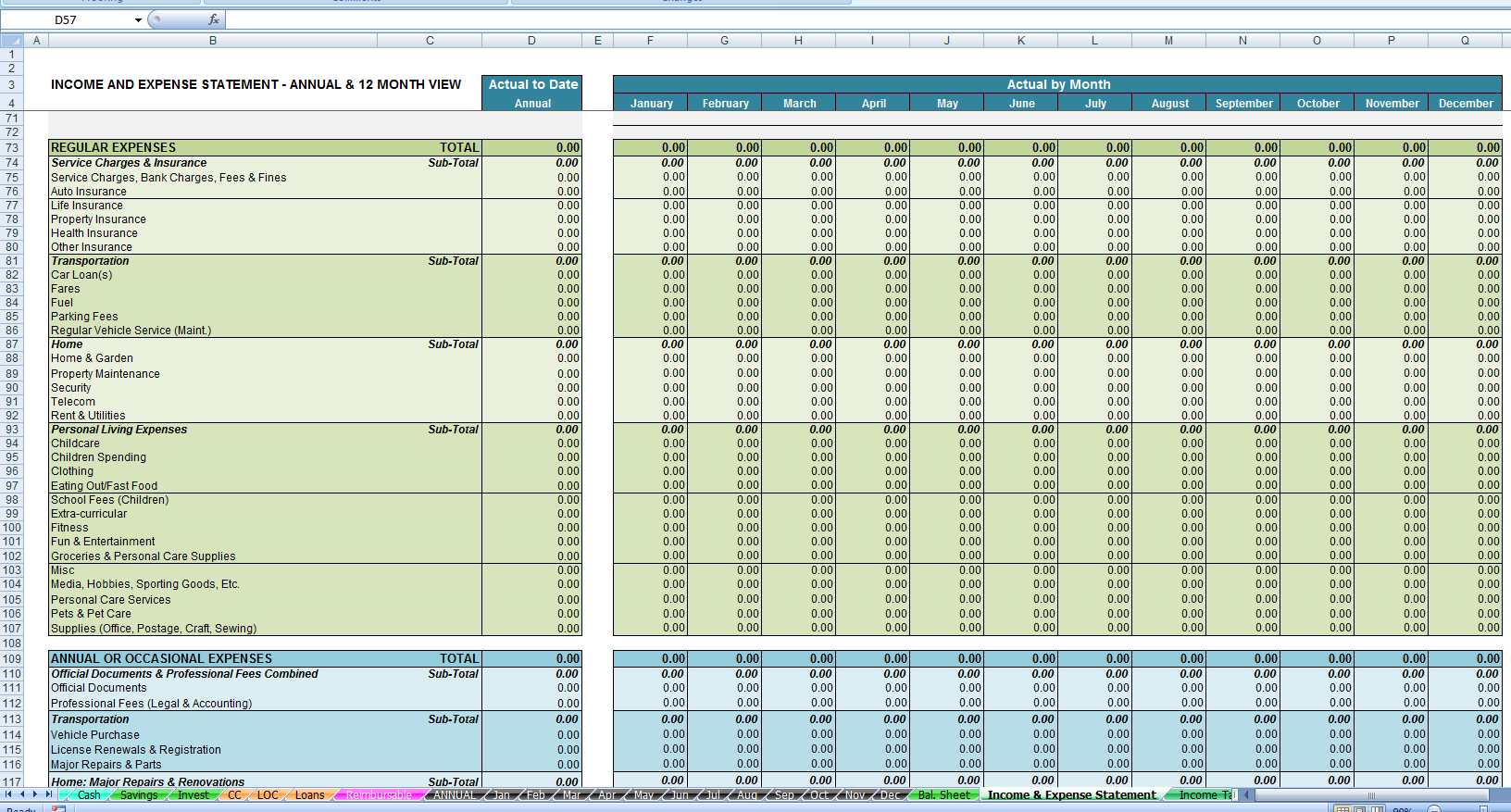

View a detailed Income and Expense Statement that gives you a summary of your income and spending, by category, annually and by month (see below for an example).

You can also view a Balance Sheet report that tells you the current balance in all of your accounts in one place, at a glance.

A third report is available that allows you to filter out tax-related transactions only. You can give this report to your accountant for preparation of your income tax return.

All transactions entered in the General Ledger are immediately and automatically reflected in your budget worksheets (as actual inflows and outflows) and all reports.

Figure Showing Portion of the Income and Expense Report

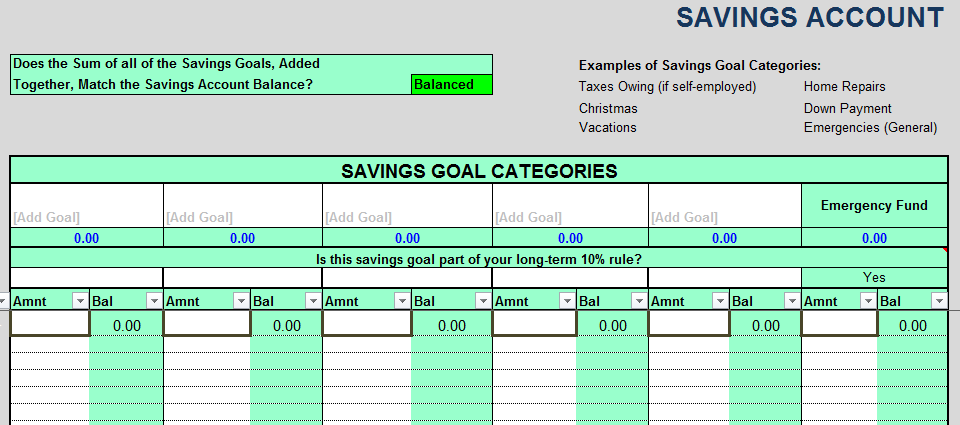

Figure Showing Portion of the Income and Expense ReportSavings Goal categories help you save money

In the Savings Account register, you can set up savings goal categories. Savings goals allow you to set aside money for spending later on irregular expenses that you know are coming up later in the year (i.e. for vacations, seasonal holidays, taxes, saving up money for a down payment, etc.) or for longer-term purposes, such as accumulating an emergency fund. This money set aside should be accounted for as an outflow in your budget (because that money is no longer available to spend on something else until you bring it back into your working account).

Any amount that you set aside each month in a savings goal will appear on your monthly budget as a budget allocation outflow.

Any amount you withdraw from a savings goal will be included as an additional inflow back into your budget for allocating to something else, as needed.

Figure Showing Savings Goal Categories

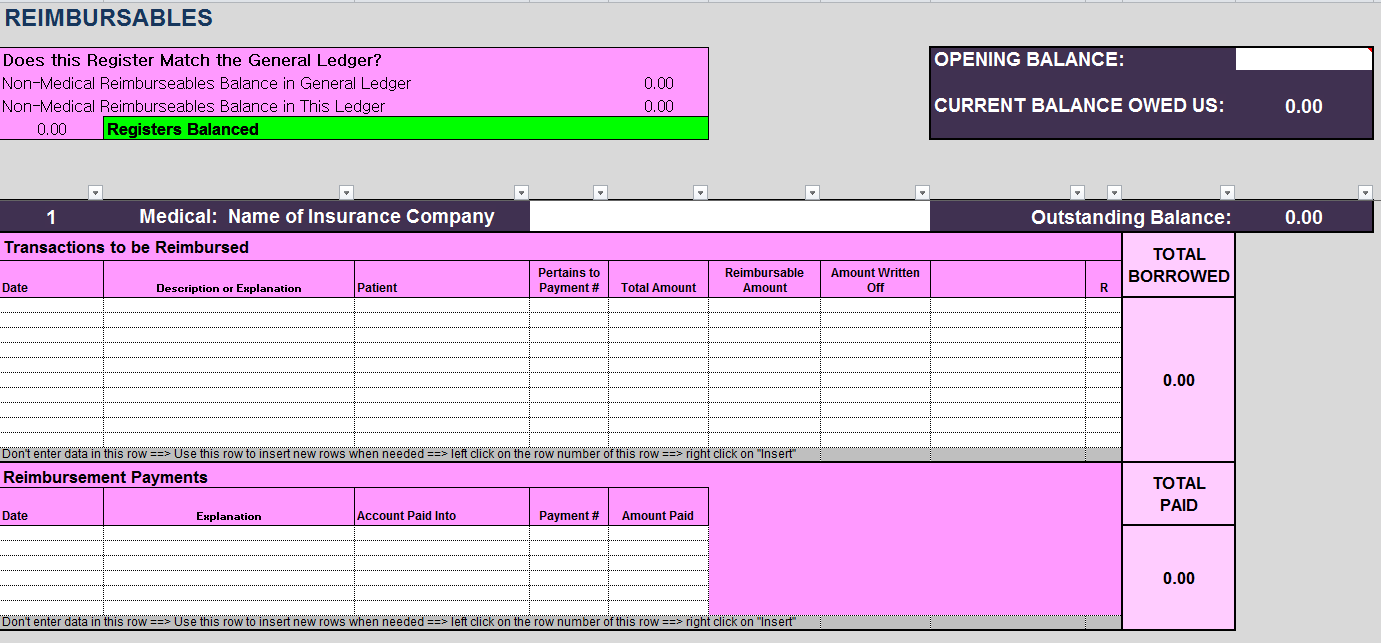

Figure Showing Savings Goal Categorieseasily Keep track of reimbursables

Let's say your dentist does not direct bill to your insurance company. You have to pay up front and be reimbursed later. Or you might be a member of your child's school parent council, and you are asked to make some purchases for the school carnival out of your own pocket. The school will pay you back later.

These are not true expenses to you because you will get this money back, but you might not get paid back in the same month that you incur the expenses. Therefore, those expenses could affect your cash flow. Thus, they should be accounted for as an outflow when you are making your budget.

That's where your reimbursable account comes in handy. Simply record reimbursable expenses and reimbursement payments in your reimbursable account.

Reimbursable expenses are shown as a separate outflow in your budgets.

Similarly, reimbursement payments to you are shown as a separate inflow into your budget.

Figure Showing Portion of the Reimbursable Account. This snapshot shows the Medical Insurance Reimbursable Register.

Figure Showing Portion of the Reimbursable Account. This snapshot shows the Medical Insurance Reimbursable Register.Accounts

Accounts in this system can be either a physical account (such as a chequing account) or an account that is just "on paper" such as an income or expense account (or "category"). Every account you use can be tracked in the General Ledger, where it is represented by a single column (as shown in the figure below).

This spreadsheet uses a different kind of double-entry bookkeeping from that used in accounting. Each entry in the General Ledger is always entered in at least two accounts. The General Ledger shows an amount coming out of one particular account (such as a checking account) and then going into another account (such as the "groceries" expense account or a physical savings account). See below for an example.

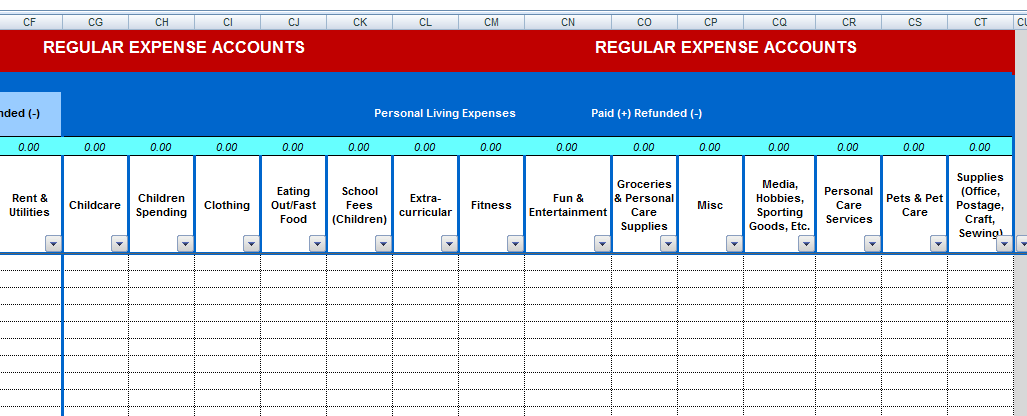

Customizable Categories

Income and expense accounts can be customized. You can change them from the default categories that come with the spreadsheet. Examples of some of the default expense accounts are shown below.

Figure Showing Sample of Regular Expense Accounts. The Labels Assigned to Expense Categories Can Be Changed By the User.

Figure Showing Sample of Regular Expense Accounts. The Labels Assigned to Expense Categories Can Be Changed By the User.Automatic Alert Messages

Automatic alert messages guide you in what steps to take to enter transactions and ensure that all data in the spreadsheet is accurate and complete.

These alert messages are colored red; they make it easier to avoid making mistakes. They lead you along in an orderly way so you know what to do next, and by paying attention to them and following them, you can be assured that the information you are entering stays consistent and accurate.

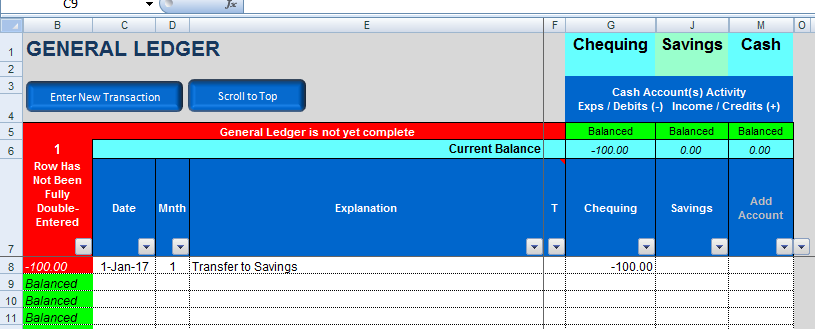

Figure Showing Red Alert Message. In this case the transfer of $100 out of the chequing account is going to be entered as $100 going into the savings account. Until it is entered in the savings account column, the General Ledger shows a red alert message alerting the user that the transaction is not yet completely recorded.

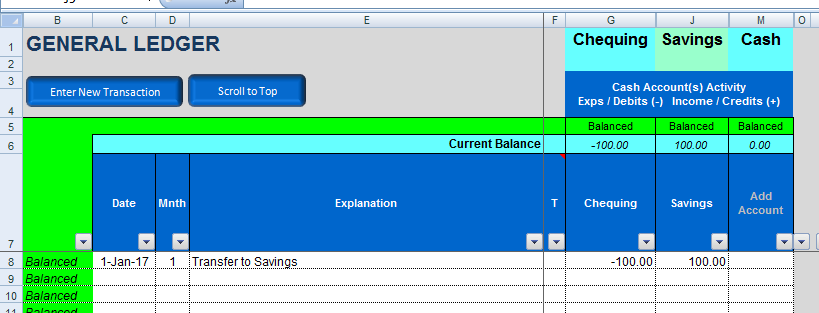

Figure Showing Red Alert Message. In this case the transfer of $100 out of the chequing account is going to be entered as $100 going into the savings account. Until it is entered in the savings account column, the General Ledger shows a red alert message alerting the user that the transaction is not yet completely recorded. Figure Showing The Red Alert Message has Disappeared Once the $100 Coming Out of the Chequing Account is Showing Going Into the Savings Account. Notice that the Red Alert Message Has Now Gone Green.

Figure Showing The Red Alert Message has Disappeared Once the $100 Coming Out of the Chequing Account is Showing Going Into the Savings Account. Notice that the Red Alert Message Has Now Gone Green.Other Features

- Each transaction can be categorized into more than one expense account, if you wish. For example, a trip to Costco might result in part of the expense being assigned to groceries and the other part assigned to clothing.

- Sort and filter transactions according to date, payee, description, category, etc.

- Reconcile hardcopy bank statements against the account ledgers in the spreadsheet.

- The spreadsheet is locked when you receive it which means that certain cells cannot be altered. Only editable cells are unlocked. The benefit to you is that you cannot accidentally delete necessary formulas or "break" the spreadsheet unintentionally. (Unfortunately, for advanced Excel users, this means you cannot fully customize the sheet).

- Keep track of investment purchases inside an investment account. **Caveat: for those of you who may be searching for an investment tracker, this spreadsheet will not be sufficient for you. While this spreadsheet, as it currently stands, is a powerful means of budgeting and keeping track of your home finances, the register for keeping track of an investment account is sufficient only for providing a place to record assets purchased. It is not sufficient for tracking the performance of your investment portfolio. For the latter, you will need additional or alternative software.

Requirements

- You must have Microsoft Excel version 2007 or later already installed on your device.

- Due to the width of most worksheets it is recommended that this file be used on a device with a 19" or larger screen. It will still work on a small laptop, of course, but you may have to use the scroll bar a lot more to see all parts of the register you are working with.

References

1. https://www.prnewswire.com/news-releases/love-and-money-people-say-they-save-partner-spends-according-to-suntrust-survey-300030921.html

2. https://www.prnewswire.com/news-releases/ally-banks-love--money-study-finds-most-americans-are-attracted-to-others-who-have-strong-budgeting-and-saving-strategies-300030715.html